Monday Morning Missives

February 23, 2026

As tax season ramps up, you'll likely hear your CPA or tax filing service ask you for "all your forms". But what does that really mean? These documents aren't just paperwork, but the story of your financial year. Here's a simple guide to the most common forms you may be asked to bring and what each one tells your tax professional.

Income Forms

W-2 (Wage & Tax Statement)

If you worked for an employer, you'll receive a W-2 from each job you held during the year. It shows how much you earned and how much tax was withheld.

1099 Forms (Various Types)

If you earned money outside a traditional employer relationship, a 1099 reports that income. Some common types include:

- 1099-NEC: Income from freelance or contracted work

- 1099-MISC: Miscellaneous Income (rent, prizes, royalties)

- 1099-INT: Interest earned on bank accounts

- 1099-DIV: Dividend income from investments

- 1099-R: Retirement income from pensions, IRAs, or annuities

Schedule K-1 (Partnerships, S-Corps, Trusts, Estates)

If you own part of a business, have investments in certain entities, or are a beneficiary of a trust or estate, you'll receive a K-1. It reports your share of income, losses, deductions, and credits.

Deduction & Expense Forms

- 1098 (Mortgage Interest Statement)

Shows how much mortgage interest you paid which is important for taxpayers who itemize deductions.

- 1098-E (Student Loan Interest Statement)

Reports the student loan interest you paid. This may qualify you for a tax deduction.

- 1098-T (Tuition Statement)

Issued by your educational institution to report tuition and eligible educational expenses. It's used to claim education credits like the American Tax Credit and the Lifetime Learning Credit.

- Form 1040-ES (Estimated Tax Payments)

If you made quarterly estimated tax payments, keep your vouchers or proof of payment. These help your CPA ensure you receive credit for taxes already paid.

This isn't a full list of every form you may receive, but a helpful introduction to the most common ones. If you have questions about finding your tax documents in Schwab, you can use their resource here:

And if you'd like help planning ahead for your 2026 tax landscape, please reach out to our team.

February 16, 2026

Happy Presidents Day from RDFA! We thought you might find the following article to have some interesting facts about the day.

Presidents Day Facts

We hope you enjoy the holiday!

John K. Ritter

[email protected]

(513) 233-0715

February 9, 2026

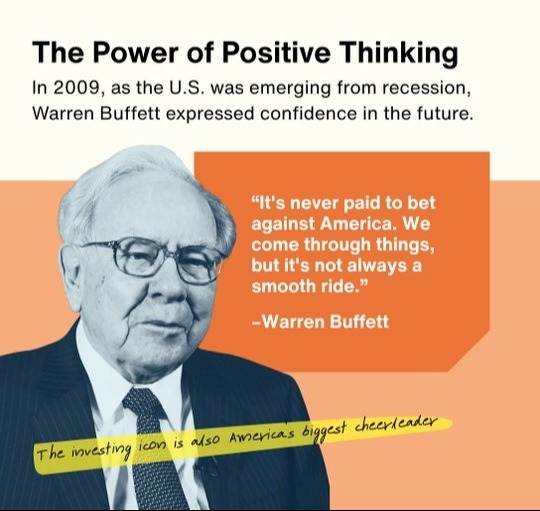

Warren Buffett’s quotes have provided clarity during confusion over the years. But his final act speaks louder than any expression. He did nothing.

As CEO, Buffett had nearly $400 billion in cash to spend in 2025. But he found no opportunities that he considered sensible. After he stepped down on January 1, 2026, Buffett said he didn’t want to be sitting on so much cash. “At certain levels, cash is necessary, but cash is not a good asset.”

For individual investors, Buffett’s takeaway message is powerful: stick to your strategy. Don’t be impulsive and make an emotional decision. Allow your guiding factors to be your goals, time horizon, and risk tolerance.

Buffett looked, but didn’t find anything in 2025 that would support his strategy. So he did nothing.

2026 will have its share of highs and lows. Remember, over the past 50 years, the stock market has, on average, pulled back by 3 percent 7 times a year. So, be prepared for some difficult stretches during the year. And be ready to do one of the hardest things for any investor: nothing.

We hope you have a great week, and please let us know if there is anything we can be doing for you. We are here to help.

February 2, 2026

We have had a few people ask lately about some of the sources of information that we pay close attention to. Where do we go for informed opinions on the economy and the markets. One such source is Chief Global Strategist Dr. David Kelly with J.P. Morgan Asset Management.

If you click the following link and scroll down just a bit, you can view Dr. Kelly's Economic and Market Update for Q1-2026.

JP Morgan Economic and Market Update

While he is only one of many voices that we listen to, he is a well respected economist/strategist and we value his opinions.

Should you have any questions, or if there is anything that we can be doing for you, don't hesitate to let us know. We hope you have a great week.

January 26, 2026

A little good news to start the day:

The latest data shows that 7 in 10 cancer patients in the U.S. now survive at least five years after diagnosis which is a remarkable improvement in long‑term outcomes. This progress becomes even more striking when viewed historically. In the 1970s, only about half of those diagnosed with cancer reached the five‑year mark. According to the American Cancer Society, improved treatments, earlier detection, and reduced smoking rates have helped raise survival rates, preventing an estimated 4.8 million cancer deaths between 1991 and 2023.

As survival continues to improve, one important aspect often gets less attention: the financial side of long-term health. More people are living well beyond their diagnosis, which means follow‑up appointments, routine screenings, and ongoing maintenance care are now part of everyday life for many individuals. This reality makes understanding your health insurance an essential part of long‑term planning.

The good news is that you don’t have to do it alone. A foundational level of insurance literacy can make a meaningful difference in both your financial preparedness and your ability to navigate care.

Here are a few key insurance concepts that can help you plan ahead:

1. Deductible

Your deductible is what you pay first before your insurance begins covering costs.

Why it matters:

- Helps you estimate potential upfront expenses in a given year.

- Useful when deciding whether to choose a high-deductible or low-deductible plan during open enrollment.

- Important for budgeting if you have planned procedures or ongoing care.

2. Out-of-Pocket Maximum (OOP Max)

This is the most you'll pay in a year for covered services. Once you reach it, insurance pays 100% of eligible costs.

Why it matters:

- Shows you the "worst-case scenario" financially.

- Critical for anyone managing a chronic condition or high-volume medical needs.

- Provides clarity on risk and protects your long-term financial stability.

3. In-Network vs. Out-of-Network

In-network providers have negotiated lower prices with your insurance plan; out-of-network providers have not.

Why it matters:

- Staying in-network can save you hundreds of thousands of dollars.

- Emergency care may have different rules, but elective services almost always give you a choice.

- You can ask your insurer or provider to confirm network status before receiving care.

4. Health Savings Accounts (HSAs)

Available only with eligible high-deductible plans, HSAs allow you to save and invest money tax-free for medical expenses.

Why they matter:

- Triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- Funds roll over indefinitely and can be invested, allowing long-term growth.

- Can offset future healthcare costs in retirement when medical spending typically rises.

Improved health outcomes are worth celebrating. But as long-term survivorship becomes more common, pairing medical progress with strong financial awareness becomes increasingly important. Understanding the basics of your health insurance helps you avoid unnecessary costs, plan for future care, and feel more in control of both your health and your finances.

Have questions about your insurance? Please reach out to our team and we're happy to help.

January 12, 2026

9 Facts About Retirement

Retirement can have many meanings. For some, it will be a time to travel and spend time with family members. For others, it will be a time to start a new business or begin a charitable endeavor. Regardless of what approach you intend to take, here are nine things about retirement that might surprise you.

- Many consider the standard retirement age to be 65. One of the key influencers in arriving at that age was Germany, which initially set its retirement age at 70 and then lowered it to age 65. 1 In 2022, there were 58 million Americans aged 65 and older. That number is expected to increase to 82 million by 2050. 3

- Ernest Ackerman was the first person to receive a Social Security benefit. In March 1937, the Cleveland streetcar motorman received a one-time, lump-sum payment of 17¢. Ackerman worked one day under Social Security. He earned $5 for the day and paid a nickel in payroll taxes. His lump-sum payout was equal to 3.5% of his wages. 4

- Seventy-eight percent of retirees say they are confident about having enough money to live comfortably throughout their retirement years. 5

- The monthly median cost of an assisted living facility is around $6,000, and seven out of ten people will require extended care in their lifetime. 2

- Sixty-six percent of retirees depend on Social Security as a major source of their income. The average monthly Social -Security retirement benefit as of January 2025 was $1,907. 5,6

- Centenarians – there are 108,000 of them as of 2024. By 2053, this number is expected to increase to 513,000. 7

- Seniors aged 65 and over spend over four hours a day, on average, watching TV. 8

These stats and trends point to one conclusion: The 65-and-older age group is expected to become larger and more influential in the future. Have you made arrangements for health care? Are you comfortable with your portfolio and investment decisions? If you are unsure about your decisions, maybe it’s time for a meeting to really dive into the details in more depth.

1. ssa.gov

4. Social Security Administration, 2025

7. PewResearch.org, January 9, 2024

Please let us know if you have any questions at all. We are here to help with all of your financial planning and investment management needs and concerns.

January 5, 2026

Written By: Kaylie Wise

The beginning of the year always feels charged with energy. We’re setting goals and making plans. But there’s one area most people overlook: their digital life.

Your phone, inbox, and apps aren’t just clutter they’re one of your biggest information storage places. Think about it: photos, passwords, financial details, personal conversations are all there. This isn’t just data; it’s an asset. And like any asset, it deserves protection.

The truth is, our digital spaces often hold more sensitive information than our filing cabinets ever did. Yet, because it’s invisible, we forget to maintain it. A neglected digital life can lead to security risks, identity theft, and unnecessary stress. Starting the year by cleaning and securing this space is one of the smartest moves you can make.

Here are a few steps to help you start fresh and protect your digital life:

- Declutter Your Photos: Delete duplicates, blurry shots, and old screenshots. Back up the ones you love to secure cloud storage.

- Uninstall Unused Apps: If you haven’t opened it in 3–6 months consider removing it.

- Clean Out Messages: Delete old conversations and large attachments. Messaging apps often hold private details.

- Empty Your Downloads Folder: Remove PDFs, images, and files you’ve already saved elsewhere. This is one of the biggest hidden storage hogs.

- Clear Browser Data: Delete old history and cache. Move passwords to a secure password manager. Browsers store more personal data than most people realize.

- Organize Notes & Reminders: Delete outdated notes and group the rest into folders. Many people store passwords or financial details in notes, but it is important to make sure they’re secure.

- Secure Your Passwords: Move all passwords to a secure password manager. Delete notes or screenshots that have passwords listed on them.

Finally, consider incorporating your digital assets into your estate plan. From financial accounts to cloud storage, these are real assets that require clear instructions for access and management. Ensure that at least one trusted individual knows your phone passcode and where to locate essential information related to your estate planning. Ask yourself: Who will manage your digital assets if something happens to you?

Your digital life is an extension of your real life and one of your most valuable assets. Cleaning it up isn’t just about freeing space; it’s about protecting your identity, your finances, and your peace of mind.

We’re committed to helping you start the year strong and secure. If you have questions or need guidance please do not hesitate to reach out.

December 29, 2025

As we hit the last Monday of 2025, I wanted to leave you with an entertaining video recap of the year in the markets. This piece by Kara Murphy, Chief Investment Officer of Kestra Financial, will remind us of what a volatile year it has been.

The "Tariff Tantrum" in April ushered in a decline that nearly reached 20%, and yet look where we sit today. It gives credence to the old adage of "It's not about TIMING the market, it's about TIME IN the market."

View the video here:

Money with Murphy 2025 Year in Review

Thank you for your partnership in 2025, and we hope that 2026 brings you health, happiness and prosperity. We look forward to continuing to work with you in the new year. All our best.

December 22, 2025

We have reached the last full week of the calendar year, and the holidays are upon us. Whether you are welcoming Christmas in just a few short days, enjoying the last day of Hanukkah today, or observing another form of celebration, we hope it all goes as you had hoped.

For me, I've already watched three of my favorite classic Christmas movies - White Christmas, Holiday Inn and It's a Wonderful Life. We've watched a fair amount of the "new classics" as well - Elf, A Christmas Story, National Lampoon's Christmas Vacation and Home Alone (both 1 and 2). Now we wait for Christmas Eve to watch what has been a tradition for us since our children were young - Polar Express before heading off to bed.

However you celebrate the holidays, may it be a wonderful time with family and friends doing the things that you most enjoy. All our best during the holidays.

John K. Ritter

[email protected]

(513) 233-0715

December 15, 2025

Stay Alert: Holiday Impersonation Scams Are on the Rise

As the holiday season approaches, fraudsters are becoming more sophisticated—using advanced technology to impersonate trusted individuals and institutions. These scams often target people when they’re most distracted and vulnerable. Protecting your identity and accounts is more important than ever.

Two Major Schwab Impersonation Threats

1. Imposters Posing as Schwab Employees

Scammers may spoof Schwab phone numbers and use real employee names and photos to gain trust. They often claim there’s a security issue with your account and request urgent action—such as sharing login credentials or verification codes. Once they gain access, they can reset passwords, lock you out, and initiate unauthorized transactions.

2. Fake Schwab Websites and Phishing Links

Fraudsters use search engine optimization (SEO) and smishing (SMS phishing) to push fake Schwab login pages to the top of search results or into text messages. These sites look legitimate but are designed to steal credentials and two-factor authentication codes.

A New Twist: AI-Powered Impersonation

In 2025, impersonation scams surged 148%, making them the most reported fraud type. Criminals now use voice cloning and deepfake video to mimic trusted individuals—including Schwab employees and even family members. These scams often start with a call or video message that feels real but is entirely fabricated.

The Impact of Identity Theft

Once fraudsters obtain personal information, they may open new accounts, apply for loans, or file false tax returns in your name. The emotional and financial toll can be severe, especially for seniors and vulnerable clients.

How to Stay Safe

- Never share Schwab login credentials or verification codes, even if the request sounds urgent or comes from someone you know.

- Use bookmarks or type URLs directly for Schwab and other important sites—avoid clicking links in search results, texts, or emails.

- Verify identities independently by calling Schwab using a trusted number, not one provided in a message or call.

- Schwab will never ask you to download third-party software or grant remote access. Be wary of any such requests.

- Place a credit freeze with all major bureaus (Equifax, Experian, TransUnion) to help prevent new accounts or loans from being opened in your name.

- Monitor credit reports regularly for suspicious activity.

- Watch for red flags: urgency, secrecy, and requests for cryptocurrency or gift cards are common scam tactics.

- Set up a family verification phrase or password for unexpected requests for help or money.

This holiday season, take time to talk with loved ones about these scams and the steps you can take to protect your identity and digital footprint. If you suspect fraud, report it immediately to Schwab and to your financial advisor.

We hope you have a great week, and don't hesitate to let us know if there is anything that we can be doing for you.

John K. Ritter

[email protected]

(513) 233-0715

December 8, 2025

We are very excited to share with you that two people from our team recently passed the CFP final examination. Lora Anstaett and Kaylie Wise both were successful in their first attempt. Lora now officially has the CFP marks behind her name, and Kaylie is simply waiting a few more months to satisfy the experience requirement before she can use the marks.

This brings the total amount of CFP professionals up to 8 between the Cincinnati and Cleveland offices, and Kaylie will make nine in early 2026. We have been, and continue to be, very dedicated to promoting the CFP certification for all advisors.

Kaylie posted the following on LinkedIn after passing the examination, and I thought you might appreciate reading her perspective.

From Finish Line to Starting Line

We hope you have a great week, and don't hesitate to let us know if there is anything we can be doing for you.

John K. Ritter

[email protected]

(513) 233-0715

December 1, 2025

Written By: Kaylie Wise

Can you believe it? We’ve officially stepped into the final month of the year. Time really does fly. While it’s tempting to dive headfirst into holiday prep and start dreaming up those New Year’s resolutions, I want to invite you to hit pause for just a moment. Before we rush into 2026, let’s make sure everything for 2025 is tied up neatly with a bow. When it comes to your financial plan, here are a few key items to check off before you fully shift gears towards the new year:

Are You In Retirement:

Take Required Minimum Distributions (RMDs)

- If you are 73 or older, make sure you withdraw your RMD from IRAs, 401(k)s, and other tax-deferred accounts by December 31 to avoid penalties

- Remember that Inherited IRA’s also have Required Minimum Distribution requirements.

- Consider using Qualified Charitable Distributions (QCDs) to satisfy the RMDs tax-efficiently if you’re 70 ½ or older.

Look to Maximize Savings:

Max Out Retirement Accounts

- 401(k), 403(b), 457: $23,500

- Catch-up (Age 50+): $7,500

- Catch-up (Ages 60-63): $11,250

- SIMPLE Plan: $16,500

- Catch-up (Age 50+): $3,500

- Catch-up (Age 60-63): $5,250

- IRA or Roth IRA: $7,000

- Catch-up (Age 50+): $1,000

Health Savings Account (HSA)

If you have a High-Deductible Health Plan:

- Single: $4,300

- Family: $8,550

- Catch-up (Age 55+): $1,000

Review 529 Plan Contributions

Recent updates expanded benefits:

- Qualified education expenses now include more items.

- Annual limit for K-12 tuition increased from $10,000 to $20,000

Consider maximizing contributions to take advantage of these accounts.

Wondering What’s New for Tax Planning:

New Senior Deduction (2025-2028)

- $6,000 per person age 65+

- Phase-out: $75,000 (Single) / $150,000 (Married Filing Jointly)

Charitable Deduction Rule (Starting 2026)

- Donations below 0.5% of Adjusted Gross Income will not be deductible if itemizing.

Consider Roth Conversions

If you’re in a lower bracket this year, converting traditional IRA funds to a Roth IRA can:

- Reduce future Required Minimum Distributions (RMDs)

- Create tax-free income later

Making Sure Your Wishes Are Clear: Reviewing Beneficiaries & Documents:

Review Estate & Beneficiary Documents

List All Your Accounts

- Create a complete inventory of bank accounts, retirement plans, investment accounts, and insurance policies.

Update Beneficiaries

- Ensure beneficiary designations are current as these override your will, so accuracy matters.

Review Wills & Trusts

- Reflect any family or life changes in your estate documents

- Confirm executors and trustees are still appropriate choices

If you need any support with this checklist, we’re here to help. Thank you for trusting us, and we hope you enjoy a productive and positive close to 2025.

November 24, 2025

As we approach Thanksgiving, we want to take a moment to express our gratitude to all of our clients, professional advisors and friends. In a world that moves quickly, it’s easy to let the days blur together and overlook the moments that give life its meaning. Gratitude is a way to slow us down and remind us that joy often hides in the ordinary and that the relationships we nurture are life’s greatest wealth.

This holiday, we encourage you to pause and reflect on the big and small blessings in your life. To help you start the week feeling thankful, here are a few questions to consider:

1. What is one simple joy you experienced this past week that made you smile?

2. Who in your life has made a positive impact on you recently, and how can you show appreciation to them?

3. What is one challenge you’ve faced this year that ultimately helped you grow?

From all of us, thank you for being part of our journey. We wish you and your loved ones a warm, joyful, and meaningful Thanksgiving. We hope you enjoy the whole holiday week.

John K. Ritter

[email protected]

(513) 233-0715

November 17, 2025

Written By: Kaylie Wise

Growing up, my family had the famous water jug filled with coins, a heavy plastic sentinel in the corner of our living room. I still remember the day I heard of someone selling a special penny for over $1 million. My dad grinned and said, “If you find one of those in our jug, we’ll go to Disney.”

That was all the motivation I needed. I spent hours hunched over that jug, dissecting every penny. After countless evenings of sorting, my grand total was… ten dollars. Not a single rare penny in sight. Looking back, that story wasn’t just about my Disney dreams—it was my first real adventure with the penny, a tiny coin that’s been part of everyday life for generations.

Fast Forward: November 12, 2025

The U.S. Mint in Philadelphia pressed the final penny, closing the chapter on more than 230 years of production. First authorized by the Coinage Act of 1792, the penny has officially been retired. Why? Because it simply doesn’t make "cents" anymore. Each penny costs about 3.69 cents to produce which is nearly four times its value.

What happens now?

Pennies remain legal tender, and with an estimated 250–300 billion still in circulation, they won’t disappear overnight. But shortages are already hitting retailers. Grocery chains are offering gift cards for jars of pennies, and some convenience stores are rounding cash transactions down to the nearest nickel, a move that could cost them millions annually. Others are rounding up, sparking calls for federal legislation to standardize rounding rules and prevent lawsuits.

Before we say goodbye, let’s pause for some penny trivia that might surprise you:

If pennies were evenly distributed across the U.S., each person would have about 720–865 pennies: roughly $7 to $9 in copper change.

The penny has been around for 233 years, making it one of the longest-running coins in U.S. history.

Lincoln was the first real person to appear on a U.S. coin in 1909 for his 100th birthday.

Things you used to be able to buy for less than five pennies:

-A stick of gum

-A postcard

-A loaf of bread (in the 1800s)

-A glass of soda at a drugstore

-A newspaper

-A handful of candy from the corner store

-A streetcar ride in some cities

So, what about those jars at home?

Banks will still accept pennies. Coin kiosks will take them. Charities are launching “Last Penny” campaigns. Or you can keep a few as a nostalgic reminder of an era when a penny saved was… well, just a penny.

Please let us know if there is anything that we can be doing for you, or if you have any questions at all. We hope you have a great week.

November 10, 2025

We've all been reading headlines about travel challenges due to the government shutdown. While the shutdown MAY be reaching a conclusion based upon events of this weekend, it did get me thinking about some travel best practices and websites/apps that have improved the overall travel experience for me and others in our firm.

A site that many of us use is Google Flights so you can compare all (or at least most) airlines in one location. You might have to then jump over to the actual booking site for the airline, but this provides a great summary to get started.

When I first book travel, I always go to the following website to check out the plane configuration. Seat Maps It's very helpful to see the plane configuration and know the best seat options available. This is especially helpful on long flights so you can see if there are seats that will allow you to stretch your legs.

Next, make sure you have your airline app on your phone. This helps with check in, flight updates, gate changes, etc.

Jeff Daniher swears by Tripit for travel planning, and especially the Pro (paid) version. This site/app will help you organize your entire itinerary in one location. He's also a big fan of Costco Travel for rental cars - solid prices and a free extra driver.

A site that I've not personally used, but many in our office have, is Viator . This website/app allows you to schedule local tours just about anyplace you would visit. I'm planning on trying this out on my next trip.

Finally, I always need to make sure I've downloaded a large selection of songs into Spotify that I can listen to on the plane. For my frequent flights from Cincinnati to Austin, I can confirm that the Hamilton soundtrack matches the flight time almost exactly...

We hope these travel tips prove to be helpful for you, especially as we approach the holiday travel season.

Please let us know if there is anything that we can be doing for you, or if you have any questions at all. We hope you have a great week.

John K. Ritter

[email protected]

(513) 233-0715

November 3, 2025

We have been getting some questions from clients about the One Big Beautiful Bill Act (OBBBA) as it relates to charitable giving in calendar year 2025. Charles Schwab Charitable - recently renamed DAFgiving360 - put out a great piece addressing some of the moving parts. You can read the article here:

In addition, here is a PDF that shows the deadlines for completing charitable gifts through Schwab. Ideally, try to take action in November if there are charitable donations that you are interested in making.

2025 Schwab Charitable Deadlines

Please let us know if there is anything that we can be doing for you, or if you have any questions at all. We hope you have a great week.

John K. Ritter

[email protected]

(513) 233-0715

October 27, 2025

With the upcoming formal merger of our three firms - Cincinnati, Cleveland and Lexington - one thing to highlight is the combined depth of dedicated financial professionals. We are very proud to have nine CFP® professionals between the three offices. Plus, we have one person who has passed the final exam and is waiting on the experience requirement, which she will obtain in the summer. And we then have five more who are enrolled in the program, with two of those actually taking the final exam in the coming weeks.

This is a quote from the CFP Board website.

"CERTIFIED FINANCIAL PLANNER® certification is the standard for financial planning. CFP® professionals meet rigorous education, training and ethical standards, and commit to CFP Board to serve their clients’ best interests."

We have long felt that the CFP® mark is the professional designation most indicative of how we want to serve our clients, and we have been long time supporters of the work of the board. Here's another quote from the CFP Board website which accurately depicts how we strive to work with clients.

"CFP® professionals take a holistic, personalized approach to bring all the pieces of your financial life together. As part of the CFP® certification, CFP® professionals also have made a commitment to CFP Board to act as a fiduciary when providing financial advice to a client. This means they have agreed to put your best interests first, so they can provide you confidence today and a secure tomorrow."

Finally, we have been fortunate over the past years that Jeff Daniher from the Cincinnati office has been a part of the CFP Board Standards Resource Commission. You can read about this group that Jeff chairs at the following link:

CFP Board Standards Resource Commission

While you are watching the World Series, or if you happen to be looking at the Wall Street Journal or Forbes, look out for commercials and ads from the CFP Board. They are doing their best to make sure that the public knows to seek out a CFP® professional when looking to financial advice.

Please let us know if there is anything that we can be doing for you, or if you have any questions at all. We are here to help. All of us hope you have a great week.

John K. Ritter

[email protected]

(513) 233-0715

October 20, 2025

Written By: Jack Hannan, CFP®

The IRS has officially finalized regulations concerning Roth catch-up contributions under the SECURE 2.0 Act. These changes could impact retirement planning for high-income earners aged 50 and older. Below is a summary of the updates.

Beginning January 1, 2026, individuals aged 50+ who earn more than $145,000 in the prior year (indexed for inflation) must make all catch-up contributions on a Roth (after-tax) basis. The income number is based on your Form W-2, Box 3 wages. This includes the newly introduced “super catch up” provision that allows those aged 60-63 to contribute up to $11,250 in 2025.

This can impact a few areas. The first being the potential for reduced take-home pay due to more income being subject to tax and withholding. Another area is the extra deduction for catch-up contributions will go away. Also, each employer’s 401k is unique in how they implement this for their employees. A change like this could prompt a review of what your employer is offering and how to best use your benefits.

Resources:

IRS Final Regulations Overview (www.irs.gov)

Forbes Summary of SECURE 2.0 Roth Provisions (www.forbes.com)

If you have questions about how these changes affect your plans, please reach out to us.

October 6, 2025

I wanted to start this Monday morning with a recap of one of our favorite nights of the year. Our firm has been a sponsor of The Great Banquet since its inception, and we are very proud to do so. The Great Banquet is a night to celebrate and honor those with special needs in the Cincinnati area. Essentially, it is a "Prom" for children and young adults with special needs, with dinner, dancing and even a talent show.

My daughter, Amanda, is one of the driving forces behind this event that is co-sponsored by Kingdom Inclusion and Young Life Capernaum. She is the leader of Capernaum in Southeast Cincinnati, which is a ministry for middle and high school students with intellectual and developmental disabilities. This ministry gives these individuals the chance to experience fun and adventure, to develop fulfilling friendships and to challenge their limits while building self-esteem through club, camp and other exciting activities.

There are a sampling of pictures above, including one of the event founder and head of Kingdom Inclusion - Stephanie Smith - along with her sister. As you'll see on the "Thank You" sign, we were charged with helping to feed the approximate 100 volunteers that evening, so there was A LOT of pasta and jambalaya made. Needless to say, my house smelled fabulous all day on Friday!

We are very fortunate to be able to help exceptional non-profit groups with our time, talent and treasure. This is one that is near and dear to my heart, and it's made even better by the fact that my whole family is there volunteering.

We hope you have a great week, and please let us know if there is anything that we can be doing for you. We are here to help.

John K. Ritter

[email protected]

(513) 233-0715

September 29, 2025

We have been fortunate of late to see a lot in the way of portfolio growth due to strong stock market conditions. But that is not the only exciting growth that we are seeing at RDFA. We are expanding in terms of both office locations and number of employees and advisors serving clients.

A month ago, Hickory Asset Management outside of Cleveland merged in with our firm. This brought three new advisors to our firm, and raised the total amount of assets under our care to just over $900 million.

We have also been working for about a year on the merger and integration of a firm in Lexington, Joule Financial. That merger should be completed just into the new year, and will bring an additional eight employees. At that point, we will be overseeing nearly $1.4 billion in client assets and will have an advisory team of more than a dozen financial planners.

We are extremely excited about this next phase of our company, and the expanded organizational depth that is being created. As part of our duty to our clients, it is important that we continue to grow our firm with talented advisors. And it is crucial that we find younger professionals who will be working with clients well past the time that some of the senior members of our team retire. While that day may be off in the future, it is something we are cognizant of and planning for.

We will continue providing information in the coming months about these developments, and we are anxiously awaiting the release of a rebranding of this combined entity. More to come on this in the near future...

We hope you have a great week, and please let us know if there is anything that we can be doing for you. We are here to help

John K. Ritter

[email protected]

(513) 233-0715

September 22, 2025

Last week, we talked about the Consumer Price Index (CPI) and what it revealed about inflation trends. This week, another major economic signal followed—this time from the Federal Reserve, often called “the Fed.”

So, who is the Fed?

The Federal Reserve is the central bank of the United States, and its job is to keep the economy running smoothly. Think of it as the system’s financial steward that helps with managing interest rates, supervising banks, and making sure money flows in a way that supports both growth and stability.

One of the Fed’s most powerful tools is the federal funds rate. This is the interest rate banks charge each other for overnight loans, but its influence goes far beyond Wall Street. When the Fed adjusts this rate, it affects everything from mortgage rates and credit cards to business loans and savings accounts.

- Raising the rate makes borrowing more expensive, which can slow down spending and help cool inflation.

- Lowering the rate makes borrowing cheaper, encouraging spending and investment to boost economic growth.

But the Fed doesn’t make these decisions randomly. It’s guided by what’s called a dual mandate which are two core goals set by Congress:

- Maximum Employment

The Fed aims to create conditions where as many people as possible can find jobs. It watches job growth, unemployment rates, and wage trends to assess how healthy the labor market is.

- Price Stability

This means keeping inflation in check. Ideally around 2% per year. Too much inflation erodes purchasing power, while too little can signal economic stagnation.

These goals can sometimes conflict. For example, stimulating job growth by lowering interest rates can increase consumer spending, which may push prices higher. The Fed’s challenge is to keep inflation from rising too quickly while still supporting a strong labor market.

The Latest Move: A Rate Cut

In response to recent signs of a slowing job market, the Fed cut the federal funds rate by 0.25%. This is their first rate cut in nine months. While inflation remains slightly elevated, job growth has cooled, and fewer people are entering the workforce. This move signals the Fed’s concern about employment and its willingness to support growth.

Looking ahead, markets expect more rate cuts through 2025, with the federal funds rate potentially falling to around 3% by the end of 2026. This shift suggests the Fed is leaning toward a more accommodative stance and one that encourages economic momentum while keeping inflation in check.

Understanding the Fed’s role and its dual mandate helps decode why these decisions matter not just for economists, but for everyday life. Whether you're saving, borrowing, or investing, the Fed’s choices ripple through the economy and shape the financial landscape we all live in.

We hope you have a great week, and please let us know if there is anything that we can be doing for you. We are here to help.

John K. Ritter

[email protected]

(513) 233-0715

September 15, 2025

The Consumer Price Index (CPI) was released this week on September 11, providing fresh insights into recent price trends and inflation dynamics. Here’s a brief overview of what the report revealed: What Is the Consumer Price Index (CPI)? The Consumer Price Index (CPI) is one of the most widely used indicators for tracking inflation in the United States. Published monthly by the Bureau of Labor Statistics (BLS), CPI measures the average change over time in the prices paid by urban consumers for a “market basket” of goods and services. This basket includes essentials like food, housing, transportation, medical care, and clothing. CPI is used to:

August 2025 CPI Report Highlights In August 2025, the CPI for All Urban Consumers (CPI-U) rose 0.4% on a seasonally adjusted basis, doubling the 0.2% increase seen in July. Over the past 12 months, prices increased 2.9%, up from 2.7% in the previous report. Key Drivers

Staying informed through tools like the CPI empowers us to make thoughtful financial choices and remain confident in our path forward. Given the latest inflation data, the Federal Reserve is widely expected to cut interest rates at its next meeting on September 17, signaling a shift toward easing monetary policy in response to cooling economic conditions, including weaker hiring numbers. Understanding these shifts helps us stay grounded, proactive, and aligned with our financial goals even as the broader landscape evolves. |

John K. Ritter

[email protected]

(513) 233-0715

Monday, September 8, 2025

September brings cooler weather, football season, and pumpkin spice everything. For these reasons it’s one of my favorite times of the year, despite the late night on Sunday watching the Ravens-Bills game... However, while we’re enjoying the start of fall, the stock market has a different reputation for this month.

You may have heard of the “September Slump” - a historical anomaly where markets tend to underperform. But does the market really hate September? Not exactly. There’s more to the story than just seasonal superstition. Check out this article to learn what’s really behind the so-called September Effect:

The moral of the story - correlation does not equal causation... Just because September has had some significant negative events in the past does not mean that is a cause to take action. That said, it makes for an interesting story this Monday morning.

We hope you have a great week, and please let us know if there is anything that we can be doing for you.

John K. Ritter

[email protected]

(513) 233-0715

Monday, September 1, 2025

Happy Labor Day! We hope you are enjoying the holiday with family and friends.

For today's Monday Morning Missive, we thought you might enjoy a brief history lesson about Labor Day. With roots back to the late 1800's, it's an interesting back story into how the holiday came to be. You can read about it here:

Have a great holiday, and as always don't hesitate to let us know if there is anything we can be doing for you.

John K. Ritter

[email protected]

(513) 233-0715

Monday, August 25, 2025

Hardly a day goes by that someone doesn’t say to me, “I’m putting off a decision until the Fed changes interest rates.” Or, they ask about the impact on rate cuts on the stock market. The market spike that we saw on Friday certainly raised those questions since the move was largely attributed to the thought/hope that rates will be lowered in September.

But I’m quick to remind people that the “rate dominoes” don’t always fall as you may expect. Here’s what could happen if the Fed makes a change following its September meeting.

Home Mortgages: When the Fed adjusts the federal funds rate, it’s a signal to banks that its monetary policy is charting a new course. In the current business cycle, it would indicate the Fed wants to spark the economy to help create jobs because it’s okay with the rate of inflation. Home mortgage rates initially may adjust on Fed news, but they may continue to change depending on the Fed’s overall message.

Credit Cards: Consumer loans also may respond to the Fed’s direction, but with things like credit cards, it’s best to see the Fed’s action as an overall trend rather than a big cliff. Banks can be expected to respond over time to remain competitive as other credit card companies adjust rates. However, your existing credit card interest rate may take a few billing cycles to reflect any Fed decision.

Auto Loans: Auto buyers may benefit if the Fed makes an adjustment, but they already received some good news when Congress passed the One Big Beautiful Bill Act. The new law allows car buyers to write off up to $10,000 a year in interest paid on qualified loans. The new rule runs through 2028, and limits apply. So car loan rates may adjust, but the OBBB may offer some other incentives worth checking out.

Have you ever heard the phrase, “If 'ifs' and 'buts' were candy and nuts, we’d all have a Merry Christmas?” It suggests that if wishes came true, everyone would get what they wanted. However, wishing is not a good way to approach personal finances.

Putting off decisions while Fed Chair Powell & Crew deliberate on rates may not be a good approach. What works best is a proactive strategy that’s based on your future. It's almost a certainty that rates will change multiple times - both going up and down - over the next period of years.

Should you have any questions for us, please don't hesitate to reach out to your advisor. We are all here to help.

John K. Ritter

[email protected]

(513) 233-0715

Monday, August 18, 2025

We have previously written about AI, and how people are using it to brainstorm ideas, analyze data and speed up routine tasks. The positive potential of AI is enormous, and still very much in its infancy. However, there is also a dark side to AI and we need to constantly be questioning what is real and what is fabricated.

Do you think you have a sharp eye for spotting AI-generated images? You can put your skills to the test with a new study from Northwestern University that challenges participants to distinguish between genuine photos/videos and those created by artificial intelligence. It’s a quick, interactive way to see how far AI visuals have come and how easily they can fool us.

Why This Matters: AI-generated content is everywhere. From social media posts to news articles to product reviews. While these tools can be incredibly helpful, they can also produce information that sounds accurate but isn’t. That’s why developing a critical eye is more important than ever.

Tips for Navigating AI-Generated Content Wisely

Always check the source: If you're reading about a topic you're not familiar with, make sure the information comes from a reputable site or expert.

Look for corroboration: See if other trusted sources say the same thing. If it’s only mentioned in one place, be cautious.

Be skeptical of perfect-sounding answers: Just because something is well-written doesn’t mean it’s true. AI can mimic tone and style convincingly.

Use fact-checking tools: Sites like FactCheck.org or even a quick search can help verify claims.

I went through about 15 of the images and videos, and it was interesting to see how quickly I was learning to detect nuances that pointed towards certain content being fake. It took a few instances to really dial in, but it took place fairly quickly. It really is amazing how "real" some of the fake content can appear.

The team here at RDFA hope you have a great week. As always, please let us know if there is anything that we can be doing for you

John K. Ritter

[email protected]

(513) 233-0715

Monday, August 11, 2025

My topic today comes from personal experience, and some "learning on the fly" that has been required. What do you need to know when a loved one is being released from the hospital post-surgery, but isn't able to return home quite yet? How do you handle the period of time in between?

In talking with one of the admissions people, it was stressed that you likely need to have at least three facilities that are on your "approved" list of places to transition to. This is due to the limited number of beds and never knowing if there is going to be availability. For example, the three facilities I'm talking with have 30, 54 and 99 bed capacity.

Second, make sure that your specific medical insurance plan is accepted. Also, different care providers may handle things differently as it relates to insurance, so you'll want to dig into the details of what is covered - or isn't.

Third, don't forget about the caregiver(s) at home. Proximity should be considered, as they'll likely be traveling to and from quite often during the stay. Ideally, the location is relatively close to their home in order to make this more convenient.

Finally, make sure to do the research and talk to the appropriate people (care facilities, hospital case worker, medical team) early on, as you don't want to be scrambling to do all of this on the day the patient is being discharged. Getting your ducks in a row a few days before the patient is released can go a long way towards insuring a smooth transition for all involved.

The team here at RDFA hope you have a great week. As always, please let us know if there is anything that we can be doing for you. We are here to help.

John K. Ritter

[email protected]

(513) 233-0715

Monday, August 4, 2025

Changes For Colleges Under OBBBA

As the school year kicks off, we want to keep you informed about impactful changes in education policy brought by the One Big Beautiful Bill Act (OBBBA). While many provisions won’t take effect until July 1, 2026, early awareness could unlock strategic planning opportunities for families with college-bound students.

Timing and What to Expect

Most changes begin with the 2026–2027 school year. The current academic year is not affected, and some students may qualify for legacy treatment on some changes, meaning they’ll be grandfathered under current rules if actions are taken before the upcoming deadline.

Federal Loan Updates

Undergraduate Loans: No changes have been made to Direct Federal Student Loans.

Parent PLUS Loans: Starting in 2026, Parent PLUS borrowing will be capped at $20,000 per year, with a maximum of $65,000 per student. Parents who take out any amount of PLUS loans before July 1, 2026 may remain under the current limits for up to three years or until graduation. The current limit is the cost of attendance at the school your child will attend minus any other financial assistance your child receives.

Graduate & Professional Loans: Grad PLUS loans are being eliminated. Annual Direct Graduate Loan limits will be set at $20,500 for graduate students and $50,000 for professional programs such as law or medicine. Students who borrow before July 2026 will be grandfathered in and can retain access to the old $138,500 cap for up to three years or graduation.

Pell Grant Adjustments

The Pell Grant maximum award remains at $7,395, but it can now only be applied toward direct education costs billed by the school, such as tuition and fees. This change may require additional planning for upperclassmen who live off campus and typically rely on those funds to help cover housing expenses. Additionally, the Workforce Pell Grant Program has expanded to include short-term accredited programs, offering increased flexibility and support for students who are pursuing nontraditional educational paths outside of the four-year college track.

Other Noteworthy Changes

The small business exclusion has been reinstated for family-owned businesses with fewer than 100 employees. While ownership in these businesses must still be reported, it will no longer impact financial aid calculations under the Student Aid Index (SAI). Additionally, student loan repayment options have been streamlined to just two plans:

· Standard Repayment Plan

· Repayment Assistance Plan (RAP) – based on AGI and dependents

529 Plan Changes

Recent updates to 529 education savings plans are already in effect and have introduced greater flexibility for families and students. The list of qualified tax-free uses has expanded to cover a variety of educational expenses beyond traditional college tuition, such as:

Books and instructional materials (including online courses)

Tutoring fees

Dual enrollment fees for high school students earning college credit

Education therapies for students with disabilities

Additionally, the annual K–12 withdrawal limit has been doubled to $20,000, offering more support for primary and secondary education costs. 529 funds can now also be used toward postsecondary credential programs, including recognized certificates, licensing, apprenticeship or credential programs regardless of if they are part of a traditional degree path.

What Should You Do Next?

If you have a student heading to college soon, you may benefit from legacy provisions before the new rules kick in. We’re here to help you navigate these updates and tailor your education funding plan.

Reach out for a personalized review and we’ll walk through your family’s options together.

John Ritter

[email protected]

(513) 233-0715

Monday, July 28, 2025

Artificial Intelligence is quickly becoming part of our everyday lives. Whether we’re using it to brainstorm ideas, analyze data, or simply speed up routine tasks, AI is transforming the way we work and think. As exciting as these tools are, it’s just as important to know how to use them responsibly. With all the possibilities AI opens up, a little guidance goes a long way in making sure we stay informed, safe, and thoughtful in how we engage with it.

Secure Our World Using AI Tip Sheet

Please feel free to send this on to anyone you think would benefit from it. As we continue to grow our firm, we appreciate you passing our name along to others, and this is a great way for them to start to learn about our firm.

Have a great week ahead.

John Ritter

[email protected]

(513) 233-0715

Monday, July 21, 2025

We announced some time back that one of our interns from the summer of 2024, Kaylie Wise, joined us upon graduation. Well, let's make that two...

Brad Ritter started his career with us upon graduation from Butler University. He was a double major in Finance and Risk Management & Insurance, and has become very interested in pursuing the CFP curriculum. He will be working as a Support Advisor, assisting our current CFP's and learning the business from the ground up.

Out of our twelve employees we now have two Ritter's, two Daniher's and two Heckle's...

You will have an opportunity to meet all of our employees at our upcoming client event. Please SAVE THE DATE of Thursday, October 30th at 5:00pm for our upcoming celebration at the American Sign Museum. We hosted a well received event there many years ago, and it has since been renovated and expanded. We are looking forward to checking it out along with all of you.

Have a great week, and don't hesitate to let us know if there is anything that we can be doing for you. We are here to help.

John Ritter

[email protected]

(513) 233-0715

Monday, July 14, 2025

Did you know that July has no less than 78 month long observances? Among the ones that jumped out at me are National Hot Dog Month, National Ice Cream Month, National Blueberry Month, National Watermelon Month, National Deli Salad Month and (you guessed it) National Picnic Month. Is anyone else suddenly hungry???

July also marks the year being halfway through. I can tell you that 2025 feels to moving by very quickly, and it's hard to believe we are already into Q3. For many of us, our New Year's resolutions may feel like a lifetime ago. You might have already accomplished what you set out to do, or perhaps your goals quietly slipped behind the scenes.

Consider: What's one intention you had in January that still matters to you today, and how can you bring it back into focus?

Now is the perfect time to check in. Whether that means starting fresh with a new goal that aligns with your current priorities, or building on the one you began earlier this year, this is your moment to reset with purpose. And if one of those goals was financial, we're here to help. Whether you want to review your progress or craft a new financial resolution for the second half of the year, let's make sure you're on track.

Here's to a purposeful and fulfilling second half of 2025.

All of us at RDFA hope you have a great week, and please let us know if there is anything that we can be doing for you.

John Ritter

[email protected]

(513) 233-0715

Monday, July 7, 2025

Over the past week, Congress has passed and the President has signed into law the "One Big Beautiful Bill Act" through budget reconciliation. There are a lot of modifications of tax law, or extensions of policies that were slated to expire. Here is a summary that might be helpful as you start to understand what has changed and what is staying the same.

We will continue digging into this new tax law and will be ready to talk with clients directly about how it may impact them. If you have any questions at all, don't hesitate to reach out to us.

Have a great week!

John Ritter

[email protected]

(513) 233-0715

Monday, June 30, 2025

From Tea to TurboTax: A Look at Taxes Through the Ages

As we get ready to celebrate Independence Day, it’s easy to forget that one of the sparks that ignited the American Revolution was… taxes! That’s right—before fireworks and cookouts, there were tariffs and tea.

1776: No Taxation Without Representation

Back in colonial times, there were no income taxes. Instead, the British Crown collected tariffs and excise taxes—fees on imported goods like sugar, paper, and tea. Colonists weren’t thrilled about paying taxes to a government across the ocean, especially one where they had no say. Thus, the famous rallying cry was born: “No taxation without representation!”

1861–1913: The Rise of Income Tax (and Its Pause)

Fast forward to the Civil War, when the U.S. introduced its first federal income tax to fund military expenses. It was short-lived, but it set the stage for what was to come. In 1913, the 16th Amendment gave Congress the power to levy income taxes permanently.

20th Century: Tax Codes Get Serious

From the Great Depression to World War II, the tax system expanded dramatically. By the 1940s, income tax had become a shared responsibility across income levels. The Internal Revenue Code of 1954 brought structure, deductions, and credits into the mix.

Today: Clicks, Credits & Complexity

Today’s tax system includes income, payroll, corporate, and sales taxes, with digital tools making filing easier (well, most of the time). While the forms may be longer than a Revolutionary War musket, the goal remains the same: funding the services and infrastructure that keep the country running.

Even as the tax landscape has evolved since the revolutionary days that first sparked America’s independence, the meaning behind this holiday remains the same: a celebration of bold beginnings, hard-won freedoms, and the enduring spirit of independence that continues to inspire us all.

If you’d like to learn more about how today’s tax landscape may impact you, our team is here to help.

We wish you a fun and safe Independence Day!

Please note: Markets will close early on July 3rd and remain closed on July 4th in observance of the holiday.

John Ritter

[email protected]

(513) 233-0715

Monday, June 23, 2025

From Kaylie Wise - RDFA Support Advisor

This past Friday, June 20, marked the official start of summer and the longest day of the year in the Northern Hemisphere. With over 15 hours of daylight, it was a reminder that time is a gift we often take for granted.

It’s a moment when the sun lingers just a little longer, giving us more light, more warmth, and more opportunity. It’s a nudge from nature to soak up every minute, to chase the things that matter, and to be present in the moments that make life meaningful.

As the days slowly begin to shorten from here, let it be a gentle reminder: every day counts. Whether it’s a small step toward a goal, a quiet moment with someone you love, or simply choosing joy over worry—make it count.

Summer has officially begun. Enjoy! ☀️

We hope you have a great week, and please let us know if there is anything that we can be doing for you.

John Ritter

[email protected]

(513) 233-0715

Monday, June 16, 2025

One part of financial planning that sometimes falls to the back burner is estate planning. Facing ones mortality and planning for that day can seem daunting, so it often falls into the "I'll get to it soon" list.

We believe proper estate planning is a key part of financial health. It's about making sure your assets go where you want, and protecting the people who matter most. One of the crucial steps you can take today for your estate planning is making sure your named beneficiaries are accurate and up to date.

The Charles Schwab article provides a great overview of what beneficiaries are and how to ensure yours are current. Taking a few minutes now can make a big difference later.

Charles Schwab Article on Beneficiaries

If you would like to have a conversation about your estate plan, we are here to help. Please reach out to us and we would be happy to schedule a time to talk.

Finally, please note that our offices will be closed on Thursday, June 19th for the federal holiday. The markets will also be closed that day.

We hope you have a great week, and please let us know if there is anything that we can be doing for you.

John Ritter

[email protected]

(513) 233-0715

Monday, June 9, 2025

On Friday I read a piece put out by a colleague in CA, and his opening struck a chord with me.

The Stock Market is not the Economy. The Economy is not The Stock Market.

This is a very simple observation, but also quite astute. While there are influences that affect both the market and economy, they don't always run in tandem. In fact, the data presented sometimes causes them to move in opposite directions. We happen to be in one of those times where the economy is showing signs of slowing down, perhaps pointing towards a recession in the near future, but the market is being stubbornly resilient.

The S&P 500 closed on Friday at 6000, which is just a small bit below its all-time high of 6147. The April stock market correction has been all but forgotten as the market rallied back in May and into early June. While we are obviously pleased to see this, we also look at it as a good time to rebalance portfolios and keep risk in check. For those clients who are drawing on their portfolios, we have continued our approach of "carving out" the expected cash needed in coming years so those dollars are not subjected to market risk. With money market yields remaining very competitive (still north of 4%) this approach is prudent.

I'll leave you with a wonderful quote from Warren Buffett: "The only value of stock forecasters is to make fortune-tellers look good." As another famous investing quote goes, remember that it is time IN the market rather than timing the market...

We hope you have a great week, and please let us know if there is anything that we can be doing for you.

John Ritter

[email protected]

(513) 233-0715

Monday, June 2, 2025

With May now behind us, I thought a post about the stock market performance might be helpful. The calendar year has been marked by volatility - both to the up side and to the down - but May proved to be quite positive. Also, diversification is really helping this year as we have seen a 16% outperformance of the EAFE (developed international stocks) over the S&P 500.

We hope you have a great start to the month of June!

Stocks advanced over the short trading week, bolstered by a possible trade deal with the European Union (EU) and an upbeat corporate report from a mega-cap tech company that creates semiconductors used in the creation of artificial intelligence.

The Standard & Poor’s 500 Index rose 1.87 percent, while the Nasdaq Composite Index popped 2.01 percent. The Dow Jones Industrial Average advanced 1.60 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, inched up 0.84 percent.1,2

EU Trades Spark Stocks

On Monday, stocks bolted out of the gate on news that the European Union agreed to speed up trade talks with the U.S. By the end of the session, the S&P 500 and Nasdaq posted gains north of 2 percent.3

Stocks fell following Wednesday’s release of minutes from the Fed meeting in May, which showed Fed officials are cautious. Some fear that trade-related economic uncertainty could increase inflation and impact the labor market.4,5

On Friday, stocks were flat despite the White House accusing China of violating its trade deal. The S&P 500 added 6.2 percent and the Nasdaq 9.6 percent for the month, their best since November 2023.6

Source: YCharts.com, May 31, 2025. Weekly performance is measured from Friday, May 23, to Friday, May 30. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Footnotes and Sources

1. WSJ.com, May 30, 2025

2. Investing.com, May 30, 2025

3. WSJ.com, May 27, 2025

4. CNBC.com, May 28, 2025

5. CNBC.com, May 29, 2025

6. WSJ.com, May 30, 2025

Take care, and we hope you have a great week. If there is anything that we can be doing for you, don't hesitate to ask.

John Ritter

[email protected]

(513) 233-0715

Monday, May 5, 2025

This is why we don't market time.....

So far in 2025, we have seen 88 trading days in the markets going into today. Volatility has come back with a vengeance this year, and that is both on the upside and downside. Consider these numbers:

19 days with the S&P 500 down more than 1%

Largest gain in a day of 9.52%

15 days with the S&P 500 up more than 1%

Largest loss in a day of (5.97%)

As of the time of this writing, the S&P 500 futures markets are up more than 3% on the news of a brewing U.S. / China trade pact. If it has felt like a roller coaster ride of late, that is a perfectly fair feeling to have. It has been quite the ride.

The old adage "it's not about timing the market, but time in the market" has been proven accurate through the years. Those who try to time the market have a tendency to get out at the wrong time, and then miss the unpredictable swings to the upside. In these markets, the most important thing is to stay diversified, rebalance the portfolio periodically, maintain some cash out of the markets, and remain patient.

Take care, and we hope you have a great week. If there is anything that we can be doing for you, don't hesitate to ask.

John Ritter

[email protected]

(513) 233-0715

Monday, April, 28, 2025

International markets are off to a strong start in 2025, but the case for global diversification runs deeper than recent outperformance. It's been a long time since we have seen such a divergence in returns between domestic and international markets, and on the year it's a difference of more than 12% between the S&P 500 and the EAFE indices.

A recent "Markets in a Minute" from Kestra Investment Management explores the timeless theory behind diversification and why it remains essential for resilient portfolios. It's a well written piece that focuses on something that we passionately believe - diversification still works.

You can read the article here: Beyond Our Borders

Should you have any questions at all, don't hesitate to reach out to us. We hope you have a great week.

John Ritter

[email protected]

(513) 233-0715

Monday, April 14, 2025

There is a relatively new planning concept that people have been discussing with us. For those fortunate enough to have excess dollars in Section 529 plans after schooling expenses have ended, there's now an option to roll dollars into a Roth IRA.

If you click the link below, it will bring up a fantastic one page chart illustrating how the process works.

If you happen to find yourself in this position, just know that there is another option that until recently didn't exist.

Should you have any questions, or if there is anything we can be doing to be of help to you, please reach out. Have a great rest of the week.

John Ritter

[email protected]

(513) 233-0715

Monday, April 7, 2025

We are excited to announce this morning that we have a new employee launching her professional career with us. Kaylie Wise interned with us this past summer, and we were thrilled that she accepted our offer to join us full time upon graduation - and after some post graduation travel.

Kaylie comes to us from the Western Kentucky University where she was a Finance major with a concentration in Personal Financial Planning. This degree program allows her to sit for the CFP Final Examination immediately, as she has already completed all of the required foundational work.

Here is a great article where you can learn more about Kaylie. This article was written after she was awarded with the Ogden Scholar Award, given to the top undergraduate student in the entire university.

Kaylie can be reached via email at [email protected], and we are very happy to welcome her to our team!

All of us at RDFA hope you have a great week.

John Ritter

[email protected]

(513) 233-0715

Monday, March 17, 2025

Kit and I took a quick trip to Columbus to see a concert this weekend, which allowed for significant time to chat in the car. One topic that arose is how much I enjoy both coaching and writing, and how my weekly emails provide a great opportunity to do both.

There's a large part of our job that revolves around financial education, and our hope is that by being well versed around economic topics our clients have better peace of mind. Interestingly, a friend of our firm forwarded an email this weekend that speaks to the topic, including an assertion that working with a financial advisor helps in increasing confidence and reducing anxiety around money.

You can read the article here: Retirement Income Literacy Study

We will continue doing our best to bring relevant articles and information to you. As always, we are here to help if there is anything we can be doing for you.

All of us at RDFA hope you have a great week.

John Ritter

[email protected]

(513) 233-0715

Tuesday, March 11, 2025

When I started to write this message yesterday morning, the markets had already opened and we could see that the selloff was intensifying. I decided to hold off so I could provide data updated through the close of business yesterday, and also to provide some perspective.

The theme of this message? Diversification.

After very strong market performance in 2023 and 2024, we are experiencing a bumpy start to 2025. The major U.S. indices are down across the board as shown below:

S&P 500 Large Cap - down 4.30%

S&P 400 Mid Cap - down 6.18%

S&P 600 Small Cap - down 8.66%

NASDAQ (tech heavy) - down 9.43%

This is where diversification comes into play, and why it is so crucial to long-term investing success. While the U.S. stock market has retreated a bit, look at what has happened with other components of an asset allocated portfolio:

EAFE International Large Cap - up 9.37%

EAFE International Small Cap - up 5.61%

EAFE Emerging Markets - up 3.81%

What about bonds and cash? Those asset classes have been helping as well so far this year:

Bloomberg Aggregate Bond - up 2.62%

U.S. 3 Month Treasury Bill - up 0.76%

All of this leads to diversified portfolios that are flat to just down a smidge this year, and highlights why it is so important to keep eggs in quite a few baskets. And it also is why we keep a healthy cash component in place for those in distribution mode, as we don't want to be forced to sell at an inopportune time.

Dealing with short-term noise and volatility is part of investing, albeit not an enjoyable part. Hopefully the information above helps to add some perspective. Should it raise any questions, please don't hesitate to reach out and ask.

All of us at RDFA hope you have a great week.

John Ritter

[email protected]

(513) 233-0715

Monday, March 3, 2025

With spring only a few weeks away, and currently being smack dab in the middle of tax season, you know what is on my mind? Spring cleaning. Decluttering. Shredding. Minimalizing...

I know someone very well (might even be related to him...) who has tax records back to the 1960's. The question is, how long do you need to hold onto past tax records? Here's a great article that addresses the topic, and the short answer is 6 or 7 years.

How Long To Maintain Tax Records

Sometimes part of the concern around getting rid of sensitive documents like tax records is how to dispose of them properly. Many people don't have shredders, or the ones they have aren't built for a high quantity of papers. Please keep in mind that we have three locked shred boxes at our office that you are welcome to use. Shred-It is on site once a month to clear them out and the documents are shredded and disposed of immediately.

If you are coming to the office, please feel free to bring any papers you would like to dispose of. We are happy to offer this to clients and friends. Please just call us first to make sure we are in the office, and we can have someone come down to help carry the documents inside. And we will very likely schedule another "RDFA Shred Day" in 2026. Our 2024 event resulted in nearly 4000 pounds (two tons) of documents being shredded!

As always, please let us know if you have any questions or if there is anything that we can be doing to be of assistance to you. We are here to help.

All of us at RDFA hope you have a great week.

John Ritter

[email protected]

(513) 233-0715

Monday, February 25, 2025

While catching up on some reading this weekend, I kept seeing three main themes:

1) The expiration of the 2017 tax act at the end of 2025, and how Congress will tackle it during this calendar year.

2) The "stickiness" of inflation, and how it may remain stubborn and hard to get back down to the 2% Fed target rate.

3) The large increases that people are seeing when they receive their home and auto insurance renewals.

I then stumbled across one article from late in the year that addresses all three of these. You can read it here.

2025 Financial Planning Outlook

Jeff recently sent me an article from the Wall Street Journal that also addresses the valuation issue for homes and home insurance. This is definitely a trend that we'll need to keep an eye on going forward.

Climate Change and Home Values

As always, please let us know if you have any questions or if there is anything that we can be doing to be of assistance to you. We are here to help.

All of us at RDFA hope you have a great week.

John Ritter

[email protected]

(513) 233-0715

Monday, February 17, 2025

With today being President's Day, I thought I would drop some interesting information about the holiday. I have to admit that it has generally not even been a holiday that I've put much energy into. Other than the markets being closed, it has felt like a "normal" day. So, I did a little reading to educate myself.

Here's a great article as a starting point:

The Truth Behind President's Day

You'll see that the holiday was originally celebrated on George Washington's actual birthday of February 22nd. His birthday is one that I always remember, as it was highlighted in the movie Holiday Inn - one of my favorite Christmas movies of all time.

It's February 22nd and I Can't Tell a Lie

It wasn't until 1968 and the passing of the Uniform Monday Holiday Act that the observance of the holiday shifted off of the actual birthday and to the third Monday of February.

Here is another article that notes many interesting key facts about Washington's life, family and home:

You'll see that he is buried at Mount Vernon, but this was not the plan that many wanted. If you ever have the good fortune of touring the U.S. Capitol, you may see a white compass stone in the middle of the building, beneath the Rotunda. This is the Capitol Crypt, and it was originally proposed that Washington be buried here. To view the area, you would have to bow to look through an observation chamber - thereby a permanent homage of bowing to the first President. But Washington, a humble and unassuming man, would not let this idea persist.

I was unaware that since 1896, a member of the U.S. Senate has read the George Washington Farewell Address. This occurs on February 22nd each year, and I've included a YouTube link if you would like to listen to the nearly 40 minute speech:

George Washington Farewell Address

Finally, many of you know that I really enjoy Broadway musicals. There's a line in the song I Know Him from the second act, sung by King George III which caught my attention. "Oceans rise. Empires fall. Next to Washington they all look small." Here's a clip of the performance from the original cast, and the incredible Jonathan Groff:

At 6'2" tall, Washington was in fact one of the tallest Presidents ever. His successor, John Adams, was one of the shortest at 5'7".

All of us at RDFA hope you have a great week, and a great President's Day holiday.

John Ritter

[email protected]

(513) 233-0715

Monday, February 10, 2025

Over the last few weeks, I've had multiple conversations with people that led to "Bucket List" discussions. A few of these have been with retired couples who are actively pursuing these trips or experiences, and some have been with pre-retirees trying to find the time to schedule them. It's always interesting to learn of the fascinating items that make up these lists for folks.

While in Austin last week for a conference, I talked to another financial advisor who said she has been working on a bucket list strategy for quite a few years. "Two a Year" has been her mantra, and since 2020 she has been working towards accomplishing two bucket list items each calendar year. She has a list with the title "I've Always Wanted To....." written at the top, and any time she thinks of an item it gets added to the list.

I have to admit that this really got me thinking, and I'm going to be making my own list. She stressed to me that not all items are costly, like overseas travel or major vacations domestically. I personally started thinking about things like:

* I've always wanted to take a serious cooking class to increase my knowledge and better my culinary skills.

* I've never hiked the Red River Gorge area in Kentucky, which seems silly considering how much I love the Hocking Hills region just north of us.

* There are a multitude of top 100 golf courses in the country that I haven't played, and some not far from my home town.

So, I have two things for you to consider. The first is to think about creating your own list of special experiences you would like to be able to enjoy. It could make for interesting conversations and planning as you think through 2025 and beyond.